NOAAQ: Compliance

Without the Chaos

Automate Notices. Minimize Risk. Protect Your Portfolio.

Products > NOAAQ

Compliance should be your shield—

not your stressor.

NOAAQ is Tekambi’s automated adverse action notification system, purpose-built for Tribal Lending Entities (TLEs) and online lenders who want airtight compliance without manual busywork.

From pre-acquisition to post-decision, NOAAQ ensures your notices are sent on time, every time—keeping regulators satisfied and your team focused on funding.

No more printing PDFs. No more missed deadlines. Just seamless compliance you can trust.

Why NOAAQ Is the Smartest Way

To Stay Compliant

Set It & Forget It (For Real)

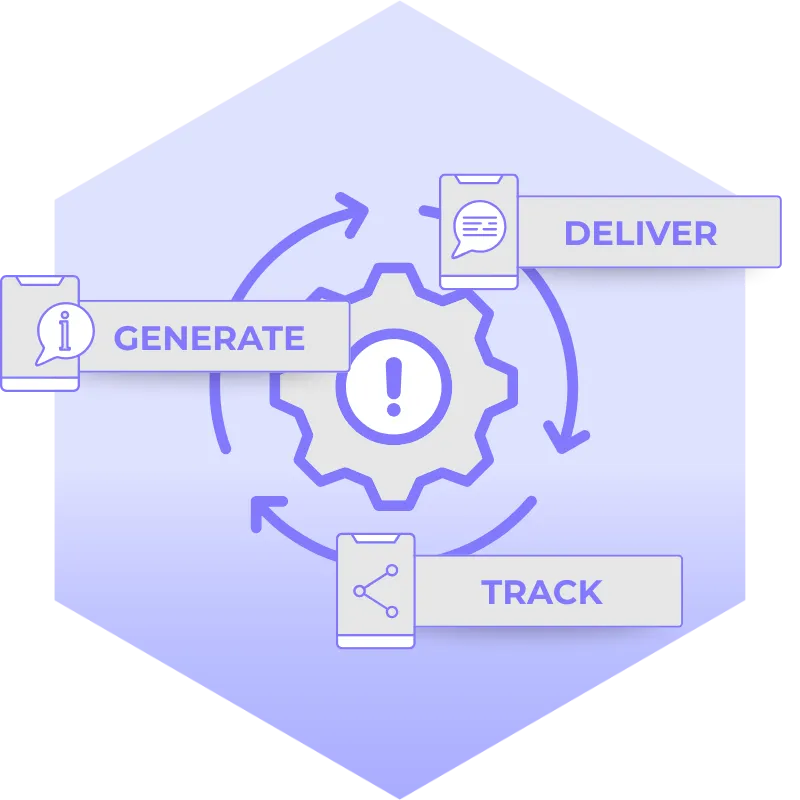

NOAAQ automates your entire adverse action process—from notice generation to delivery and tracking.

It's hands-off after initial setup.

Tailored for Tribal Lending Entities

Built specifically for the unique requirements of TLEs, NOAAQ helps you meet regulatory standards without custom development or legal guesswork.

Full Audit Trail? You Got It.

Every notice is timestamped, archived and fully trackable—giving you instant access to historical logs when audits or reviews hit your inbox.

What's Under the Hood?

NOAAQ isn’t just another compliance plugin.

It’s a fully integrated system designed to eliminate risk and elevate operational efficiency.

Automated Adverse Action Notices

Trigger notices in real time based on lender-defined criteria. No delays, no manual errors.

Pre-Acquisition

Notifications Support

Stay compliant even before funding decisions are made with pre-decision disclosures baked in.

Customizable

Message Templates

Personalize content by product, campaign or borrower profile to align with regulatory and brand needs.

Centralized Compliance Reporting

Access comprehensive logs, delivery status and audit histories in a few clicks.

Secure, Encrypted

Delivery

Enterprise-grade security ensures borrower data stays protected—and regulators stay happy.

Effortless

Integration

Easily connect with CRM, NOAAQ, and underwriting tools—no dev work needed with Origin8.

Zero-Code Integration: Launch faster with turnkey APIs and built-in compatibility with your

LOS, CRM and underwriting platforms—no developer required.

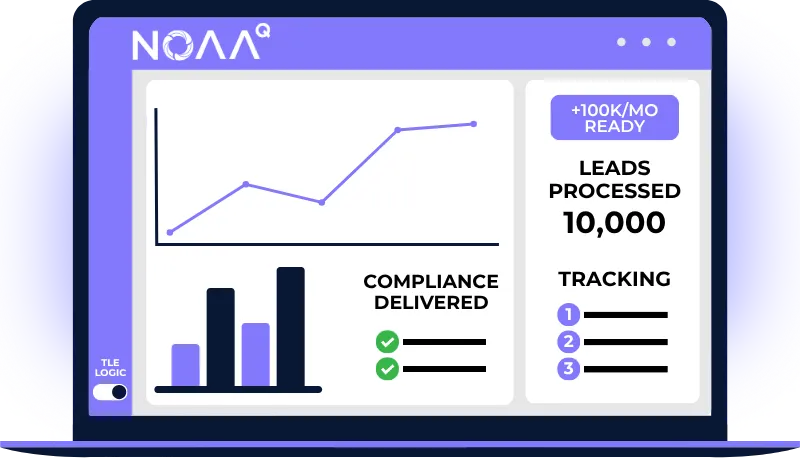

Built to Scale Without Breaking

Whether you’re managing 100 or 100,000 leads per month, NOAAQ adapts in real-time—delivering speed and accuracy as your portfolio grows.

Serve hundreds or thousands of borrowers? We’ve got you covered.

Want to reduce manual oversight? This was made for you.

Need TLE-specific logic? That’s our specialty.

Whatever your needs, NOAAQ's got you covered

TLE Compliance Problems?

Solved.

The Manual Burden

Manual adverse action processes are prone to missed deadlines and human error.

Solution

NOAAQ automates notice generation and delivery, ensuring every notice is sent on time.

The Tribal Lending Maze

Tribal Lending Entities face complex and unique compliance standards.

Solution

NOAAQ is built specifically to handle the compliance requirements of TLEs out of the box.

The Audit Scramble

Lack of visibility and difficulty producing historical records during an audit.

Solution

NOAAQ provides a full, timestamped audit trail of every notice, making you instantly audit-ready.

The Integration Headache

Integrating with existing loan systems is complex and requires developer work.

Solution

NOAAQ offers zero-code integration with CRM, LOS, and underwriting platforms.

The Scaling Struggle

Compliance processes can't scale as your portfolio grows, leading to chaos.

Solution

NOAAQ is built to handle thousands of leads, adapting in real-time as your business grows.

The Notification Gap

Notices are delayed or not confirmed as delivered, creating compliance risk.

Solution

NOAAQ ensures on-time delivery with automated scheduling, logging, and confirmation.

NOAAQ doesn't just send notices—it confirms delivery, logs actions and alerts your team to any exceptions,

so nothing falls through the cracks.

Compliance Shouldn’t Slow You Down.

It Should Keep You Moving.

At Tekambi, we don’t believe in duct-taping compliance onto your workflow. NOAAQ is built to fit seamlessly into your stack—automated, auditable and always on.

Sleep better knowing compliance is covered.

With NOAAQ, you’re always audit-ready. Our detailed logs and timestamped records give you full visibility and peace of mind—no scrambling, no surprises.

SITE LINKS

SISTER LINKS

FOLLOW TEKAMBI