Origin8:

Smarter, Faster

Loan Decisioning

Approve More. Waste Less. Scale Without Limits.

Products > Origin8

Approve More. Waste Less. Scale Faster

Your loan decisioning engine should be your top-performing employee—not your most confusing spreadsheet.

Origin8 is Tekambi’s intelligent, real-time decision engine that gives lenders total control over their underwriting process. No more canned logic. No more chasing code changes. No more sacrificing speed for accuracy.

Real-Time

Lead Decisioning

Decide leads instantly - no spreadsheet needed

No-Code

Rule Customization

Set up rules with an

easy-to-use interface

Built-In

Lead Filtering

Enhanced lead quality with robust filtering

Smart Routing for

Higher ROI

Send the right leads to the right lenders

Modern, Intuitive User Interface

Why Origin8 Works Like a Charm

And a Workhorse

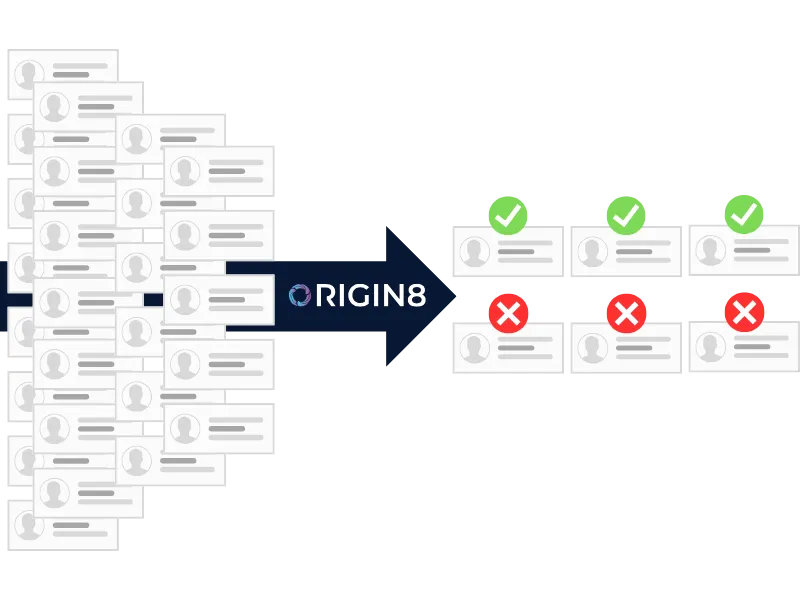

Eliminate Bad Leads

Before They Waste Your Time

Origin8’s pre-screening filters kick junk leads to the curb in milliseconds. Fraud, bots and no-chance applications? Gone.

Your team can focus on borrowers that actually fund.

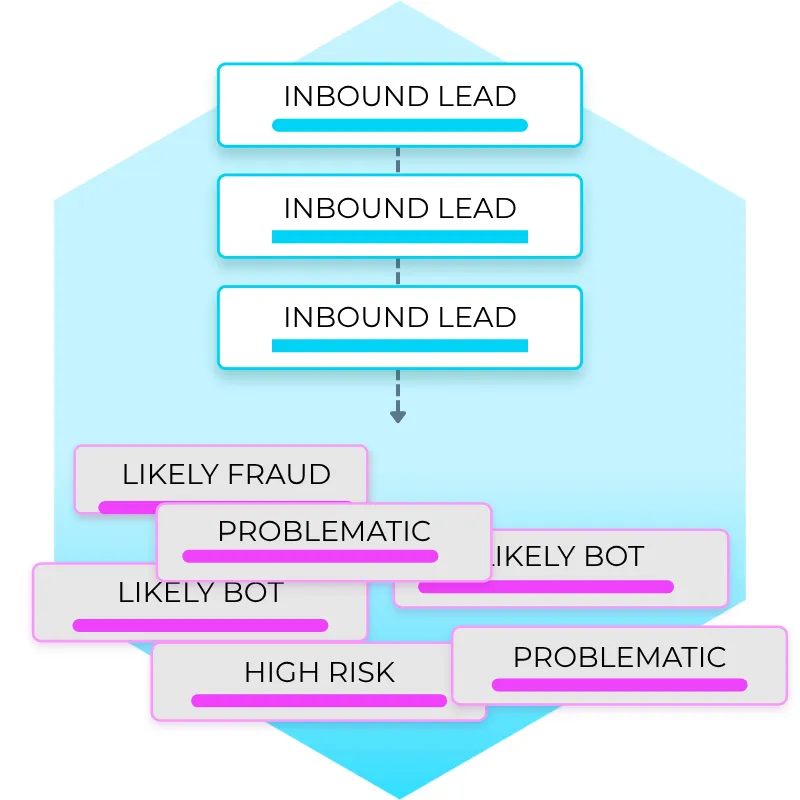

Customize Scorecards On the Fly

Without a CS Degree

Need to adjust your decisioning rules? You can do it in real time—no developers, no help tickets, no delays.

Origin8’s flexible rules engine adapts to your strategy, not the other way around.

Smarter Routing Based on

Real Lending Logic

Route leads based on what matters—new vs. returning, CRA score, performance and more. Send each application where it’s most likely to convert and drive revenue.

What's Under the Hood?

Origin8 is loaded with features designed to make your decisioning faster, smarter and way more profitable:

75+ Data Vendor

Integrations

From credit bureaus to alt-data, fraud tools to income verifiers—plug in instantly, score intelligently

Custom

Pricing Models

Tailor offers based on borrower risk profiles and market behavior. Profit more while staying competitive.

Powerful

Decision Tech

No batch jobs. No waiting. Origin8 analyzes, scores, and routes leads in real time.

Advanced

Risk Scoring

Identify top borrowers with customizable models that blend credit data, behavioral signals, and performance metrics.

Audit-Ready

Reporting

Keep your compliance team happy with crystal-clear, timestamped decision logs.

Effortless

3rd Party Routing

Automatically route leads to your in-house team or top-performing buyers based on rules you control.

Built for lenders who know every second (and every decision) counts.

Built for Lenders Who Want More

Than a Basic Engine

Other platforms make you choose between flexibility and functionality. With Origin8, you get both—plus a UX that makes underwriting logic actually make sense.

Whether you're funding in-house or routing to a network, Origin8 is the command center you've been missing.

No code? No problem.

Need custom logic? You got it.

Running multiple campaigns? We’re built for it.

Fine-tune performance with rule-based logic.

Origin8 Solves Lenders' Problems.

Hover over the problem, get the solution.

Junk Leads Waste Time

Fraud and no-chance apps clog your queue.

Solution

Origin8 pre-screens in milliseconds—bad leads out, fundable in.

Rule Changes Are Slow

Dev tickets and delays stall your strategy.

Solution

No-code rule edits in real time—zero engineers, zero wait.

Missed Routing Revenue

Good leads die instead of finding a buyer.

Solution

Smart routing sends each app to the best lender or buyer automatically.

Pricing Isn’t Precise

One-size offers hurt margin and win rate.

Solution

Custom pricing models match risk and market to maximize profit.

Batch Decisions Bottleneck

Slow cycles delay approvals and cashflow.

Solution

Real-time analysis, scoring, and routing—decisions instantly.

Audit & Compliance Pain

Messy logs make reviews stressful.

Solution

Audit-ready, timestamped decision logs keep compliance happy.

Decisioning That Feels Like a Superpower

At Tekambi, we know lending tech shouldn't require a PhD or a 6-month implementation. Origin8 is built for fast movers, bold testers, and growth-hungry lenders who are tired of systems that can’t keep up.

You're not just managing leads anymore—you’re managing momentum.

Let Origin8 help you make every decision a winning one.

SITE LINKS

SISTER LINKS

FOLLOW TEKAMBI