Risk-Based Pricing:

Make Every Offer Count

Solutions > Risk-Based Pricing

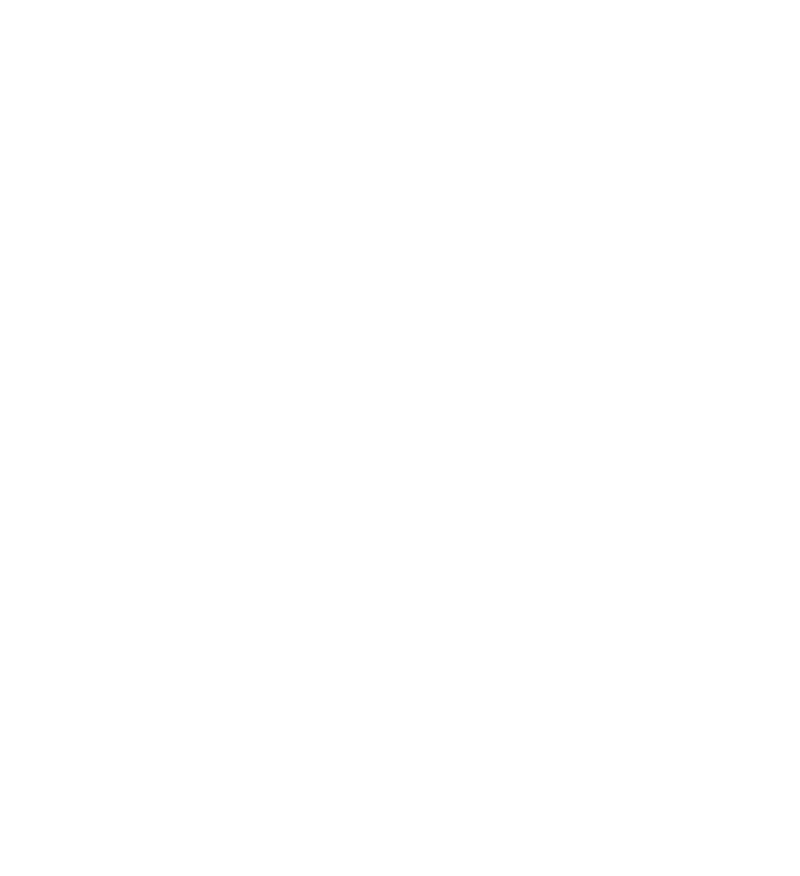

Smarter Pricing = Smarter Lending

Not all borrowers carry the same risk—so why price them that way? Tekambi’s Risk-Based Pricing engine helps you tailor offers dynamically based on credit profiles, behavior, and performance trends.

Increase approvals, reduce charge-offs and win more business with surgical pricing models.

Turn Data Into Decisions That Drive ROI

Our platform allows you to evaluate potential customers based on a number of factors, including past loan performance (when available to help you fine-tune your strategies and maximize your lending ROI.

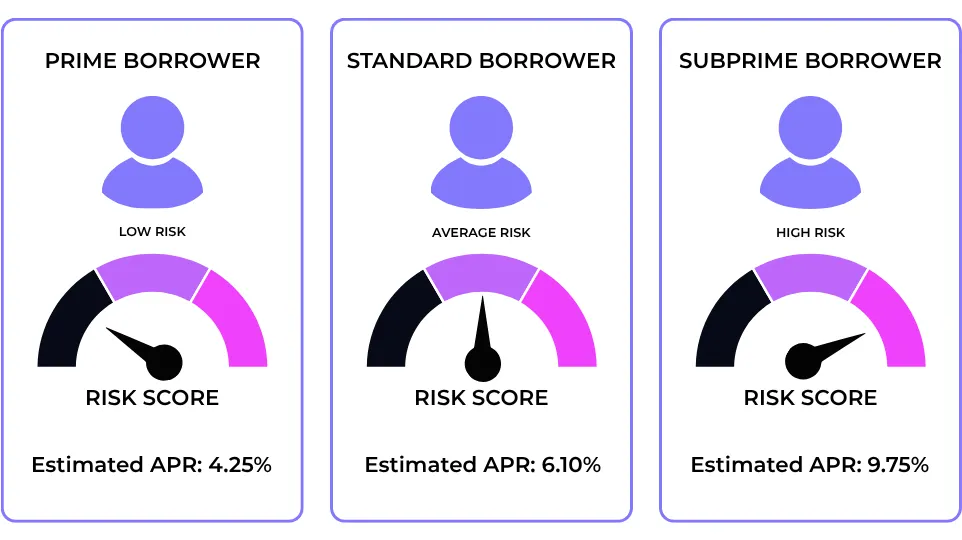

Feature Highlights

Smart Filtering; Block duplicates and low quality sources to fit your business rules

Real-Time Routing: Instantly deliver leads to your best-fit destinations

Real-Time Routing: Instantly deliver leads to your best-fit destinations

Campaign Control: Customize rules for specific customer segments

Performance Analytics: Conversion rates, CPL, CPF; you see it all.

Lead Source Integration: Sync directly with publishers and affiliate partners

Personalized Offers, Profitable Outcomes

Almost NO

Downtime

Tekambi's serves & software are so stable and well-maintained that there's almost never any downtime, so you can rely on smooth sailing.

Compete Without Sacrificing Margin

Offer flexible rates that win customers and protect your bottom line. Get the win without the risk.

Route with

Surgical Precision

Our software recognizes that not all borrower are the same, and should never be treated as such when it comes to pricing.

Turn data into decisions that drive ROI.

Use Tekambi's Risk-Based Pricing Solutions to:

Approve more borrowers without losing margin

Adjust pricing based on real-world performance

Increase profitability per funded loan

Automate what used to take hours of manual effort

Scale smarter with segmented strategies

Better rates. Better margins. Better borrowers.

SITE LINKS

SISTER LINKS

FOLLOW TEKAMBI