Automated Underwriting

At Lightning Speed

Solutions > Automated Underwriting

Smarter Lending Starts with

Smarter Decisions

Tekambi’s Automated Underwriting delivers lightning-fast, tailored decisions, replacing spreadsheets with precision risk modeling.

Customize rules, check data in real-time and approve more borrowers without compromising standards or overwhelming your team.

No delays. No bottlenecks. Just instant decisions that drive growth.

What Powers Tekambi's Underwriting Engine?

Real-Time Decisioning – Instant application scoring and routing

Dynamic Scorecards – Adjust risk models in minutes, not weeks

75+ Integrations – Plug into leading credit, fraud, and alt-data vendors

Audit-Ready Logs – Full transparency for compliance and internal review

Smart Routing – Leads you buy or acquire by direct mail can be routed anywhere you want.

Pre-Funding Triggers – Simplify decisions even before credit pull or income verification to streamline early-stage screening

Why Automated Underwriting Is a Lender’s Best Ally

Approve Fundable Borrowers in Seconds

Ditch manual processes. Our real-time engine evaluates applications instantly—no hold-ups, no handoffs.

Custom Rules,

No Developers Needed

Build and update decision logic on the fly to reflect your risk appetite, campaign goals, or market shifts.

Data-Driven,

Not Data-Overwhelmed

Pull from 75+ integrated sources—credit, fraud, income, and more—without the technical overhead.

Tekambi empowers lenders to move fast with precision. From instant risk scoring to intelligent fallback routing, our automated underwriting platform removes friction and boosts conversion—without compromising compliance or control.

Use Tekambi's

Underwriting Automation to:

Slash decision time from hours to seconds

Increase approvals without taking on extra risk

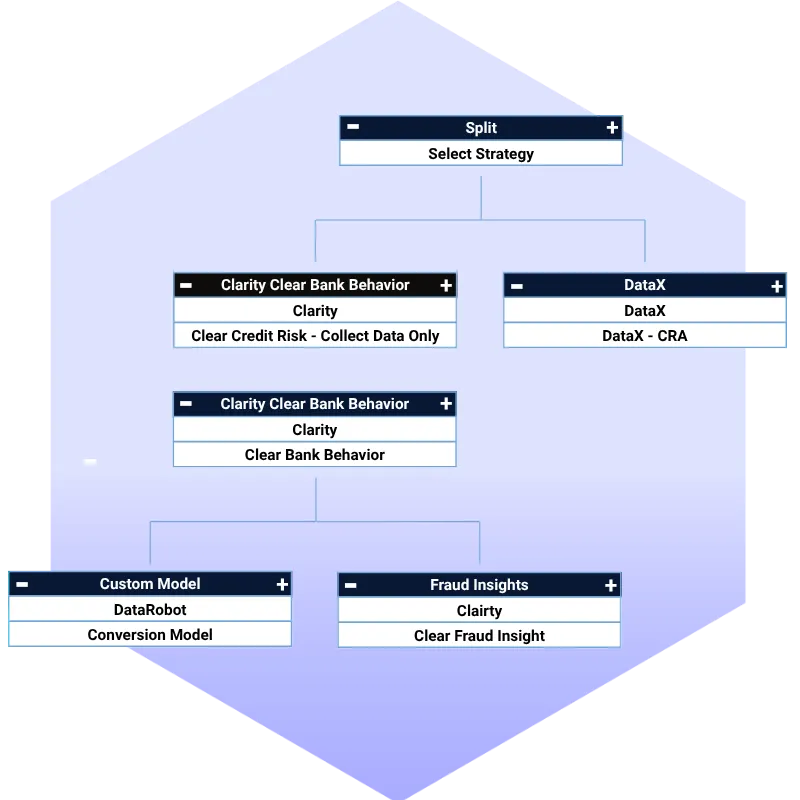

A/B test underwriting strategies effortlessly

Stay agile with rule updates you control

SITE LINKS

SISTER LINKS

FOLLOW TEKAMBI