Smarter Lead Management & Decisioning for Lenders

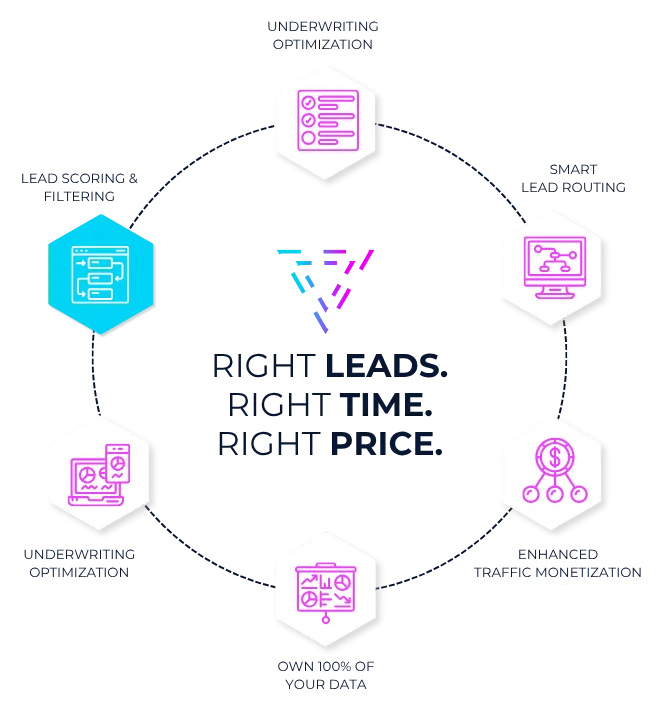

Right Lead. Right Time. Right Price.

We calculate all economic indicators and understand feasibility of advertising campaign

More Loans,

Less Waste

Smarter lead management for better borrowers at lower costs.

Monetize Every

Lead

Maximize revenue with advanced routing and tracking.

Custom Tech,

Zero Hassle

Scalable lending solutions built for you.

The Smarter Way to Buy, Manage & Convert Leads

If you’re still drowning in overpriced leads and slow underwriting, you’re leaving money on the table. Tekambi was built to slash lead costs, cut underwriting time and boost funded loans.

We help lenders turn leads into funded loans faster, cheaper and smarter—so you spend less, approve more and grow faster.

No fluff; just results.

Why More Short-Term Lenders

Choose Tekambi

Most platforms can give you leads. Tekambi helps turn them into revenue.

Lead Management,

Without the Guesswork

Control lead flow, block bad sources, and filter out the noise—so only the best borrowers make it through.

Smarter Underwriting,

On Your Terms

Build and customize decision models that fit your business—no coding, no rigid rules, just better approvals.

Ping Trees to

Maximize Every Lead

Buy, sell and route leads in real time with our powerful marketplace—no wasted spend, no middlemen.

Ironclad Security

Built for Lenders

Protect sensitive data with enterprise-grade encryption and SOC 2-certified security—compliance you can trust.

Data Vendors

At Your Fingertips

Instantly connect with 30+ third-party data sources to strengthen your underwriting decisions.

Compliance Built for Tribal Lending Entities (TLEs)

Tekambi’s built-in NOAAQ notifications keep you compliant from click to close—customized for Tribal regulations, and fully automated.

Lead Management & Decisioning Tools Built for Short-Term Lenders

Most platforms give you leads. We help you turn them into revenue.

Origin8: Smarter, Faster

Loan Decisioning

Your decision engine should be a profit machine, not a bottleneck. Origin8 gives you complete control over your lead velocity with dynamic campaigns, precision filtering and automated routing.

Successful Satisfied

Projects Customers

Minimize bad leads before they hit your queue

Build and customize scorecards on the fly

Alternative routing and custom modeling with zero coding required

It's underwriting, without the bottlenecks

Agora Lead Selling:

Turn Your Traffic into Revenue

You have traffic. We have the tools to monetize it. With Agora, you can help customers find solutions while driving your revenue.

Turn clicks into cash: Sell your organic traffic effortlessly.

Smart lead routing: With advanced pixel and click tracking.

Maximize every lead’s value: Whether you fund it or sell it.

NOAAQ Compliance Notifications: Stay Covered, Stay Compliant

Managing compliance doesn’t have to be a headache. Tekambi’s NOAA (Notice of Adverse Action) platform keeps you on the right side of regulations with automated pre-acquisition notifications tailored for Tribal Lending Entities (TLEs).

Timely, automated compliance notices

Centralized audit-ready tracking

Secure, seamless integration into your workflow

Custom-Built Lending Tech for

YOUR Lending Operation

Lending Tech, Built for You—By Experts Who Get It

Off-the-shelf software doesn’t fit every lender. That’s why Tekambi builds custom solutions—fast. From underwriting models to workflow automation, we deliver what you need to grow without the overhead.

Skip the hassle of hiring an in-house tech team

Get lending technology that scales with your needs

Rapid deployment, no unnecessary delays

Need scorecards, routing, risk-based pricing or e-Sign integration? We build it on demand—just the way you need it.

TESTIMONIALS

Lenders Using Tekambi Approve More Loans & Maximize Every Lead

"Integral part of our success"

"Tekambi has been an integral part of our success. The employees truly care and work hard to bring solutions to bear quickly and with accuracy. We wouldn't have had the success we have been able to achieve without their partnership."

Dan P., Portfolio Manager

"Excellent, flexible system"

"Excellent, flexible system, and even better support. Oscar and the rest of the team have always gone out of their way to help us, and they always respond quickly."

Lou V., General Manager

"Always evolving and keeping up with their customers"

"Tekambi has substantial knowledge and expertise in many other areas of the business, apart from underwriting. One of the strengths of Tekambi is the fact that they are always evolving and keeping up with their clients' needs, changing industries, and regulatory environments."

Eric W., Owner

3 Simple Steps Between You and

Smarter Lead Management

1

Book an Expert Demo

We’ll show you exactly how Tekambi makes lead management effortless.

2

Customize Your Strategy

Optimize your lead flow, scoring, and underwriting with our team of experts.

3

Scale with Confidence

Get better leads, smarter decisions, and higher profits.

No fluff. No wasted budget. Just better lending.

Latest Updates

Coming soon!

Subscribe to Tekambi's

Newsletter

Get key lending tips and resources and make the most of Tekambi's tools to maximize your lending operations profitability and growth.

Tekambi is the Competitive Edge You Didn't Know You Needed

Lenders who use Tekambi approve more, spend less, and scale faster.

Your competitors are upgrading their lead management strategy—are you?

SITE LINKS

SISTER LINKS

FOLLOW TEKAMBI